In today’s rapidly evolving financial scene, demat accounts are an absolute necessity for investors. Your investment experience can be improved by opening a Demat account, regardless of whether you are an experienced trader or a novice who is trying to enter the stock market. This is why you should open demat account right now.

Simple, Safe Investments

Demat accounts let you keep securities electronically instead of paper certificates. This transition streamlines investment management and boosts asset security. No more worrying about document theft, damage, or loss. A demat account keeps your savings safe and accessible with a few clicks.

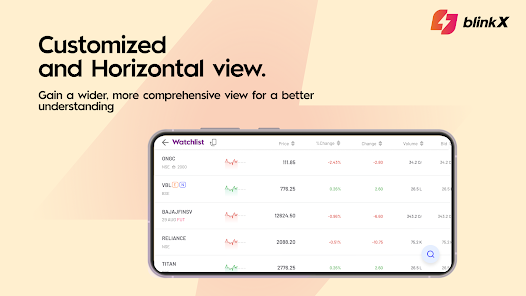

Smooth Integration with Online Investment Apps

Online investment apps have transformed investing in the digital age. These applications make investing easier with their user-friendly UI and many functions. Linking your demat account to an online investment app lets you manage your portfolio anywhere. Integrating demat accounts with online investment platforms simplifies market tracking and real-time trades.

Effective Trading

Anyone interested in stock trading needs a trading account. Demat accounts are commonly coupled with trading accounts to make buying and selling stocks easy. This combination smooths trade by executing transactions quickly and efficiently. A trading account linked to your demat account makes trading stocks, bonds, mutual funds, and more easy.

Online Trading App Convenience

Online trading apps have made trading easier than ever. These apps let you make judgments with real-time market information, advanced charting, and analytical resources. You may trade anytime, anywhere with an online trading app and demat account. This convenience is ideal for busy people who need market access.

Simplified Demat Account Opening

The Demat account opening process is now quite simple. Many financial institutions and brokerage organizations allow you to open an account online from home. KYC verification usually consists of only a few simple papers. Your demat account can be activated days after verification, allowing you immediate access to internet trading.

Promotes Investment Variety

Demat accounts aren’t just for stocks. Your investments can include bonds, ETFs, government securities, and mutual funds. This diversity lets you design a balanced, diversified portfolio that matches your financial goals and risk tolerance. Centralizing your investments simplifies portfolio administration and tracking.

Cost-effective, transparent

Cost-effectiveness is a major benefit of demat accounts. While demat accounts include fees, they are generally outweighed by the benefits, such as fewer paperwork and faster transactions. Investment and trading apps usually have transparent cost structures, so you know what you’re paying for.

Improves Corporate Benefits Management

It is easier for businesses to reap the benefits of demat accounts, which include dividends, bonus issues, and rights difficulties. Considering that the benefits are promptly credited to your account, you won’t be missing out on any of them. Spending less time on investment planning is made possible by this automated strategy.

Conclusion:

Lastly, opening a demat account is something that investors in the financial market need to do. As a result of its convenience, safety, and effectiveness, it is indispensable for contemporary investors. When you use online investment or trading apps, having a demat account will make your experience overall more favorable. Because the procedure of opening a demat account has been simplified, now is the ideal moment to accomplish this.